08 July 2013

Part 2 - Stock Market Primer questions answered

Click here to listen to this podcast

Welcome to the Stock Market Primer follow-up --part 2. Here I will again answer questions about investing in the stock market. The questions are ones that time did not permit me to answer during a recent meeting in which I was invited to be a guest speaker. The small group ministry or life team hosting the meeting was the Strategic Business Relationships and Career Transition group which is lead by Carlyn Davis from Covenant Church in Carrollton Texas.

To recap the meeting goals, at the end of the meeting I wanted the ladies attending to have the following take-aways:

1. Have scripture references that confirm that Christian financial principles encourage investing.

2. Understand stock securities and be able to read a stock quote.

3. Have an understanding of our key US Stock Markets (Dow, NASDAQ and S&P 500) including what they represent and their all time high values.

4. Be able to follow market / investing conversations on financial

TV shows by having knowledge of Bears and Bulls, Insiders, Market Capitalization, Market Sentiment, SEC and a host of other US Stock Market terms and concepts.

With a title like Money reVerse, you know that I must take the opportunity to reintroduce biblical scripture that contains principles that we should apply to our personal money management practices. Here's additional biblical scriptures that encourage investing.

Biblical Scriptures that Encourage Investing

"The plans of the diligent lead surely to plenty, But those of everyone who is hasty, surely to poverty." Proverbs 21:5 NKJV

The primary reason that we invest is to make money. Period. In managing money and investments take the wisdom of this scripture to heart and be one that makes plans and that is diligent. A diligent person uses care and conscientiousness in everything they do. They think things through, create action plans and they make things happen! The contra action of diligence is to act quickly with little information - and the scripture here states that the plans of those will lead to poverty. As I share with you on investing, I'm keeping the wisdom from this scripture in plain view. I want to encourage and promote diligent approaches not only to investing but in all money management strategies.

Because the Lord is the owner of everything and we are stewards of His resources, we should also be diligent in seeking Him for guidance in our investment strategies. Here's a scripture from Isaiah that confirms this truth.

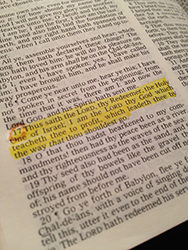

"Thus says the Lord, your Redeemer, The Holy One of Israel: 'Iam the Lord your God, Who teaches you to profit, Who leads you by the way you should go.'"

Isaiah 48:17 NKJV

I will continue to seek the Lord's guidance as I make investments and as I daily manage all of the financial resources that He has entrusted to me. Scripture here confirms that He teaches us to profit and leads us by the way we should go. Again, see the management of your personal and business finances in scope to be governed by this scriptural truth. Strive to be a great steward of all things entrusted to you by the Lord. Can you commit to join me and also seek the Lord for guidance in investments and in the daily management of your finances?

Did you notice that instead of good steward I said great steward? Subtle but noticeable difference... More to come on this

Now on to answering the final questions presented by the group attending the Stock Market Primer session

IPO - Initial Public Offering

Q: Why is it good to get in on a stock investment at IPO time?

A: The biggest draw to buying a stock at the time that it's IPO or Initial Public Offering launches is the possibility that the investment will turn out to be like getting a winning lottery ticket - buy the stock for a low price and cash in within a few days when the stock doubles or triples in price. The expectation is that with all of the focused marketing and the excitement and energy generated around the first offering of the stock, the demand to get in early will drive the stock price high in a short period of time. For anyone that got in at that initial price, that would translate into quick profits. For example, look at the SeaWorld Entertainment IPO (stock symbol SEAS) that took place on Friday April 19th 2013. It was filed with the SEC and officially announced to the public on December 27th 2012. During the 4 months between the time that the IPO was announced and it's launch date there were many news stories and press releases about the company and the stock offering. The initial stock price was proposed and debated by market analysts in the public eye for 4 months. Now, let me tell you what SeaWorld entertainment did on Friday April 19th 2013 - the IPO Launch day. On that day, just before the New York Stock Exchange opening bell, all the traders and TV viewers were energized by a parade of SeaWorld performers, live penguins, otters and other animals marching across the actual NYSE trading floor.

SeaWorld Entertainment stock opened at $27 a share and closed at $33.52 a share on it's first day of trading - a profit of $6.52 a share for those that were able to get in at the $27 price. If you purchased 100 shares on that opening day at that opening price, you banked an additional $652 profit - a 24% return. Not bad at all for a single day of trading against a single stock! Again, it's the possibility of first day of trading profits like this or better than this drives investors to IPOs in large numbers.

(at the time of this writing, I have no open positions in SeaWorld Entertainment stock or derivatives.)

Q: How do you know when a company will IPO?

A: Great question! There are many online sites that detail information on companies that are scheduled to go public. To find some of this information do a google search on IPO Calendar. Personally, my favorite place for digging into the details of scheduled IPOs is on the NASDAQ site. The web address is www.nasdaq.com/markets/ipos.

Q: How can someone that is a small investor participate in an IPO? Can they?

A: I don't have a definition for what could be classified as a "small investor", but I can say that anyone that has the required funds in a brokerage account on IPO day can participate in an IPO. I must make you aware that sometimes the demand for that brand new stock on the market is so great that it will be like you're standing in a long line waiting to make your purchase. In that case you make the stock trade and you keep checking for the purchase confirmation that never seems to come... I've been there a few times!! There are no minimum purchase quantities set on the number of stock shares that must be purchased. Using the SeaWorld Entertainment IPO as an example - anyone could participate in that IPO for as little as $27 - the opening price to purchase one share of the stock. To simply answer the question, yes - a small investor can participate in an IPO. Even if that small investor is you!

Insiders

Q: Can you explain Insider trading?

A: Ahhh... thanks for the question. I'm thankful for the opportunity to correctly explain this term better than I did in the session.

An insider is a company officer or director or any individual that owns more than 10% of the voting shares or voting rights of a company. Technically, insider trading is the buying and selling of any securities by anyone that is considered to be an insider. These are the folks that are invested in the daily operations and strategies of the company and therefore may have access to information about the business activities and plans that are not known to the general public. These are the people that could play a role in making key decisions that could be business impacting like merging with or acquiring another company, expansion the business operations or having products being evaluated for recall actions. Because these individuals have this type of information, they could buy or sell stock based on this knowledge before it is released to the general public and that would be unethical. Again, for our protection the SEC requires that companies make key business information available to the general public through the regulatory reports. For this reason the SEC regulates the stock trading activities of insiders by monitoring for suspicious activity and requiring full disclosure of their trading activities to the general public.

When ever we hear about "insider trading" it is usually associated with SEC investigations surrounding allegations of trading violations. This is the example that I used in the session. While the use of the words insider trading in relation to violations is the correct wording, I wanted to also clarify that the trading of any stocks and other securities by anyone considered to be an insider technically is considered to be insider trading - even with no violations. Great question!

Q: When stock prices drop - could these declines be caused by insiders leaking confidential company information?

A: You know I guess anything is possible. More than likely when a stock drops in price this is not the case. There is just no good reason for an insider to say something negative about something that is theirs to improve to make it more valuable. Think about it like you're selling your car. Would you start spreading around information that could cause your car to be worth less money (for instance, the car has bad smell that can't be removed, engine is not good, unsafe vehicle, desirable by thieves...)? Not likely if you really want to sell your car. Same with an insider. They have a vested interest in the company and if they are a company officer or director they are paid to help to make the organization more profitable thus increasing the value of the stock. Leaking negative company information could cost the individual their job or even have stronger disciplinary actions. To simply answer the question, it is possible but not likely in my opinion.

Q: Do we have access to information on company insiders to get details on their investment activities?

A: The short answer is yes! Thanks to the SEC regulations, full disclosure of company financial information, business operational plans and insider stock purchasing and selling activities is readily available to the general public! Having access to this information takes the mystery out of knowing how the company being operated. Because of this, information about the associated trading activity of the officers of every public company is included in their company profile. This information is easily accessible by anyone that has an interest. Pre-investment company research steps will quickly reveal these details.

Again, to those that attended the Stock Market Primer session, you were a outstanding group! You got it! I can tell from the conversations that we had after the session that day and as I've chatted with several of you since then. You are intelligent and have no problems comprehending new financial concepts and ideas. You can trust yourself to begin the forward motion into a new season of promotion when it comes to all things financial. Profiting through investing is in your near future. Receive it!

Thanks again to Carlyn Davis for inviting me as a speaker for this meeting and I pray financial promotions to all meeting attendees and to all Money reVerse readers.

If you'd like to see more teaching on investing, let me know. My goal is to serve you!

Carolyn

To read my previous article in this series Click Here