11 September 2016

Happy Labor Day and 401k Day!

For one week every fall, we begin the week with Labor Day and end the week with Retirement!

Labor Day is a familiar day to us. What may be unfamiliar is that the Friday after Labor Day is deemed 401(k) day according to the Plan Sponsor Council of America (PSCA). This organization is committed to promoting the use of profit sharing, 401(k) and other savings and incentive programs by increasing awareness of their benefits to business, employee, government, media, and the academia communities. This organization is driven by the belief that corporate savings and incentive programs strengthen the free-enterprise system, empower and motivate the workforce and improve domestic and international competitiveness.

Participating in company sponsored savings plans like a 401(k) or 403(b) (for non-profits) is a great way to get retirement savings automated and consistent. Participating in these plans involve making an election to have a percentage of your wages automatically deferred and redirected to your retirement savings account. Many organizations provide a matching contribution for funds that are saved by the employee which is a great partnership to help you to grow this fund more quickly! 401(k) day is organized to remind everyone to begin or increase their commitment to saving for this latter season of life.

For one week every fall, we begin the week with Labor Day and end the week with Retirement!

Labor Day is a familiar day to us. What may be unfamiliar is that the Friday after Labor Day is deemed 401(k) day according to the Plan Sponsor Council of America (PSCA). This organization is committed to promoting the use of profit sharing, 401(k) and other savings and incentive programs by increasing awareness of their benefits to business, employee, government, media, and the academia communities. This organization is driven by the belief that corporate savings and incentive programs strengthen the free-enterprise system, empower and motivate the workforce and improve domestic and international competitiveness.

Participating in company sponsored savings plans like a 401(k) or 403(b) (for non-profits) is a great way to get retirement savings automated and consistent. Participating in these plans involve making an election to have a percentage of your wages automatically deferred and redirected to your retirement savings account. Many organizations provide a matching contribution for funds that are saved by the employee which is a great partnership to help you to grow this fund more quickly! 401(k) day is organized to remind everyone to begin or increase their commitment to saving for this latter season of life.

Take advantage of your company offerings!

According to a March 2015 National Compensation Survey conducted by the US Department of Labor only 64% of individuals that have access to a company sponsored retirement plan are making the choice to participate. Of this 64% of participants there is a higher adoption rate for state and local government workers than those in private industry. If you are currently not participating in a retirement savings plan available to you, the key takeaway here is to get started today!Retirement in the Bible

Retirement as we customarily envision it is not a concept that is directly promoted in the bible with one exception. The exception is the instruction given to Levites to withdraw from the tent of meeting services when they reach age 50 (Numbers 8:23-25). The concept here and in other biblical passages is that the Lord has called each of us to a work and he will give us the strength to do the work to which we are called. While this is true, it is expected that as the body grows weary, the work should become easier to better match your physical capabilities. In our practical lives, retirement is a time in which the work that we do becomes easier and not as demanding. For most of us, this will be accomplished as we withdraw from or reduce the amount of time we spend in corporate career and entrepreneurial activities. In preparation for this time, we should save money during the working years for this season of life. With this in place, the demand for the income that comes from corporate or self-employment should be reduced. This is the goal!How much of your earnings should you save for retirement?

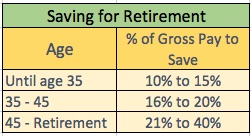

How much of your earnings should you save for your retirement? The specific answer is one that will be determined as a part of an individual retirement needs assessment exercise. No problem if you haven’t completed such an assessment! When participating in your company sponsored plan, all that is needed is for you to determine a percentage of your gross income that is to be deferred and redirected to retirement savings. Personally, I use and recommend an age-based savings percentage that increases later in life. Wondering how you could possibly save this amount of your income? As you pay down your debt obligations and strive toward living a no-debt lifestyle this becomes possible. In the tax year 2016 there is an $18k limit on the total dollars that you can defer. Those over age 50 can defer an additional $6k annually. Depending on your level of compensation and number of total participants in the plan, company sponsored retirement plans may further restrict the amount of your income that you can save tax-deferred. Max out the amount that you can save tax-deferred in your company plan and make up the difference by redirecting your post-tax monies to an individual savings or investment account.

If you are self-employed or your employer does not have a sponsored retirement saving plan you will have to take the initiative to save for your later years. Work to save a portion of your income monthly and work up to the percentages listed above. After your nest egg begins to grow you will be ready to explore investment options to help to generate a return on these funds. It’s not difficult and I feel that everyone will be able to develop a strategy that works for them. Money reVerse is here to help with encouragement, information and one-on-one consulting engagements. Contact me to get more info!

Prepare for the day in which your work will be lighter and less demanding. Aggressively save for your retirement by taking advantage of your company sponsored retirement savings plan! Do it today!

Wondering how you could possibly save this amount of your income? As you pay down your debt obligations and strive toward living a no-debt lifestyle this becomes possible. In the tax year 2016 there is an $18k limit on the total dollars that you can defer. Those over age 50 can defer an additional $6k annually. Depending on your level of compensation and number of total participants in the plan, company sponsored retirement plans may further restrict the amount of your income that you can save tax-deferred. Max out the amount that you can save tax-deferred in your company plan and make up the difference by redirecting your post-tax monies to an individual savings or investment account.

If you are self-employed or your employer does not have a sponsored retirement saving plan you will have to take the initiative to save for your later years. Work to save a portion of your income monthly and work up to the percentages listed above. After your nest egg begins to grow you will be ready to explore investment options to help to generate a return on these funds. It’s not difficult and I feel that everyone will be able to develop a strategy that works for them. Money reVerse is here to help with encouragement, information and one-on-one consulting engagements. Contact me to get more info!

Prepare for the day in which your work will be lighter and less demanding. Aggressively save for your retirement by taking advantage of your company sponsored retirement savings plan! Do it today!